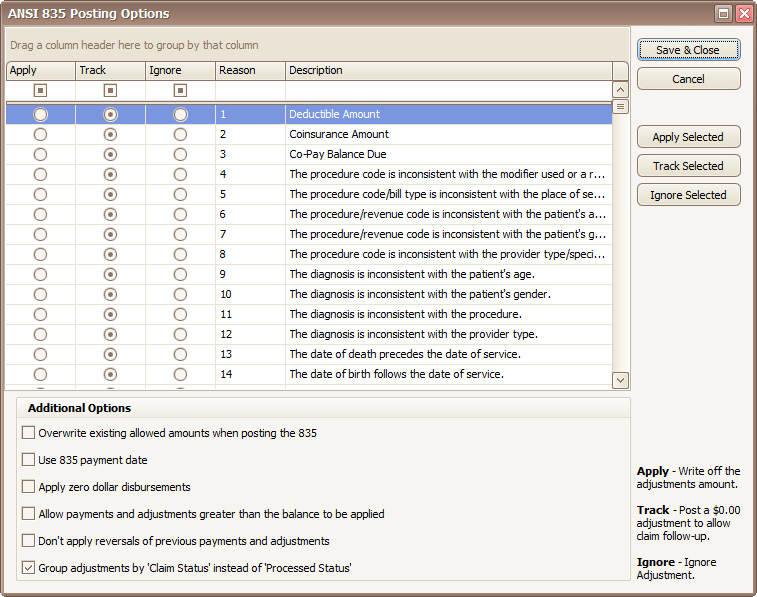

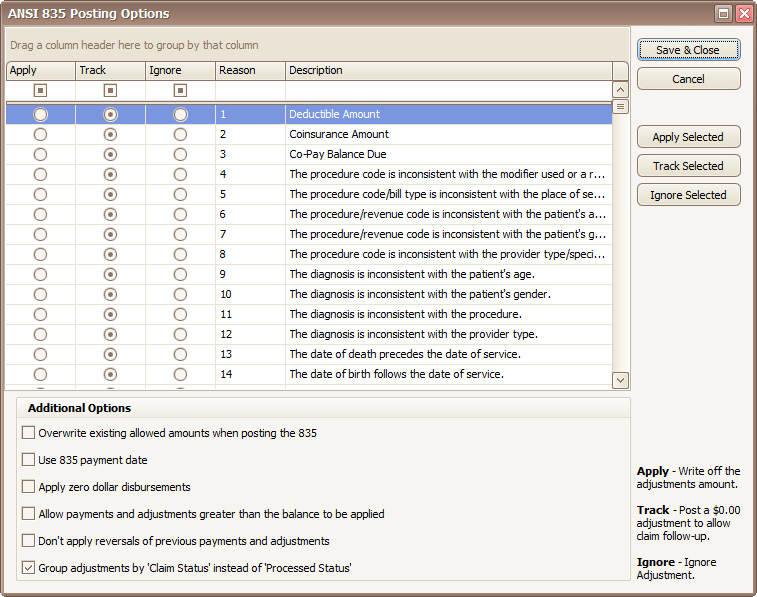

•These are company level options. If a user changes these options, they apply to all users.

•Use this screen to automatically select the appropriate action when applying an 835.

•Click on the ‘Options’ button to select options for posting payments.

•Options are set to ‘Track’ by default.

•To select multiple Reason codes, hold down the Ctrl key to select individual options. Once highlighted, click on ‘Apply Selected’, ‘Track Selected’ or ‘Ignore Selected’ to apply.

•Options that have been changed will be displayed in Pink.

Apply - Adjustments will be posted with the dollar amount.

Track - Adjustment will be posted with a $0.00-dollar amount to allow adjustment tracking and easy claim follow-up. The description will contain the dollar amount in the format $X.XX from the 835. This setting is normally used when there is a denial and you want to flag the claim for follow-up.

Ignore - Adjustment is ignored. This setting is normally used when the EOB has an adjustment amount but it should not be posted because the monies will be coming from another party. Such as copay or deductible amounts.

Overwrite existing allowed amounts when posting the 835

Checked - Existing allowed amounts will be overwritten with the 835-allowed amount if the 835 value is greater than $0.00.

Unchecked - 835 Allowed amounts will be applied if the existing allowed amount is $0.00 and the 835-allowed amount is greater than $0.00.

Use 835 payment date as posting date

Checked - The program will use the 835 Payment Date as the posting date for payments and adjustments contained in the 835. Important Note: After checking this box on the Options screen, you must close and reopen the current ERA for this to take effect. It will then be defaulted for future ERA auto posting.

Unchecked – The program will use the current date.

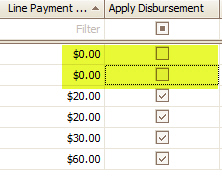

Apply zero-dollar disbursements - Note: Zero dollar payments from denied claims will not be posted.

Checked – The program will apply payments with a $0.00-dollar amount.

Unchecked – The program will ignore $0.00 payments.

Important Note: After checking this box on the Options screen, you must still manually check the ‘Apply Disbursement’ boxes for any $0.00 line payment amounts in the current ERA. This option will then be defaulted for future ERA auto posting.

Allow payments and adjustments greater than the balance to be applied

Checked – The program will apply payments and/or adjustments even if it would cause the service line to have a negative balance.

Unchecked – The program will not apply payments and/or adjustments that would cause the service line to have a negative balance.

Don’t apply reversals of previous payments and adjustments

Checked – The program will not apply payments or adjustments from claims with a status code of 22 (Reversal of Previous Payment).

Unchecked – The program will apply payments from claims with a status code of 22 (Reversal of Previous Payment). Adjustments may also be applied depending on the Apply, Track, or Ignore setting.

Note: The program does allow posting adjustments related to reversals, even if the “Don’t apply reversals…” box is checked. In these situations, the action of these adjustments will always initially be set to ‘Ignore’ but the user can change that to ‘Apply’ or ‘Track’ as needed. All adjustments are shown in the lower grid, no matter whether or not the reversals box is checked.

Group adjustments by ‘Claim Status’ instead of ‘Processed Status’

Checked – The program will group adjustments by claim status

Unchecked – The program will group adjustments by processed status